- Community Home

- >

- Services

- >

- The Cloud Experience Everywhere

- >

- How to use Predictive Modelling & Machine Learning...

Categories

Company

Local Language

Forums

Discussions

Forums

- Data Protection and Retention

- Entry Storage Systems

- Legacy

- Midrange and Enterprise Storage

- Storage Networking

- HPE Nimble Storage

Discussions

Discussions

Discussions

Forums

Discussions

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

- BladeSystem Infrastructure and Application Solutions

- Appliance Servers

- Alpha Servers

- BackOffice Products

- Internet Products

- HPE 9000 and HPE e3000 Servers

- Networking

- Netservers

- Secure OS Software for Linux

- Server Management (Insight Manager 7)

- Windows Server 2003

- Operating System - Tru64 Unix

- ProLiant Deployment and Provisioning

- Linux-Based Community / Regional

- Microsoft System Center Integration

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Community

Resources

Forums

Blogs

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Receive email notifications

- Printer Friendly Page

- Report Inappropriate Content

How to use Predictive Modelling & Machine Learning (Excel + Azure)

Financial predictive modelling provides organisations with the framework necessary to predict valuable customer and business insights.

But, as well as streamlining internal processes, financial predictive modelling and machine learning can be the boost financial services need to stay one step ahead of their competition.

When executed properly, this emerging technology can provide a better experience for both your actuarial team and your customers. For instance, insurers that use weather forecast insights to underwrite more accurate policies are likely to be more:

- Risk-aware

- Cost-effective

- Offer a more consistent customer experience

But to reap the rewards of financial predictive modelling and machine learning, you first need to choose the best strategy.

In this blog post, we’ll talk you through how your business can revamp your predictive modelling and machine learning efforts with improved Excel modelling capabilities, as well as Azure’s data-driven services.

Excel: the Roots of Predictive Modelling

In 1997, the Excel user-base soared to more than 30 million users worldwide, making it the most popular spreadsheet program ever created.

In the process, the software proved itself to be the king of data-processing, providing organisations with the opportunity to build statistical models and analyse more than a millionrows of data.

To this day, the program remains the backbone of many financial predictive modelling efforts with a third of businesses considering it the dominant analytics and data science tool. It’s not surprising. Excel is built with a suite of self-service analytical tools, allowing you to connect data from across your organisation and build sophisticated models.

Power Pivot, for example, is an add-in that businesses can use to connect large pools of data from across a range of sources, create Excel models, analyse their findings and share their insights. Add-ins like these build upon Excel’s data analytic capabilities and allow you to use certain functions that were once unavailable, such as:

- Creating hierarchies

- Using key performance indicators

- Writing advanced data calculations.

However, your financial predictive analytics journey with Excel can only take you so far. Certain limitations will inevitably hold your business back as it grows, including:

- Restricted memory and an inability to scale on-demand

- Limited processing power

- Expensive on-premises infrastructure investments

- Limited security and control

For financial businesses who require intra-day or even real-time data-processing to fuel their predictive analytics projects, Excel needs a modern upgrade.

A match made in the Cloud: Pairing Excel’s Modelling with Azure’s capabilities

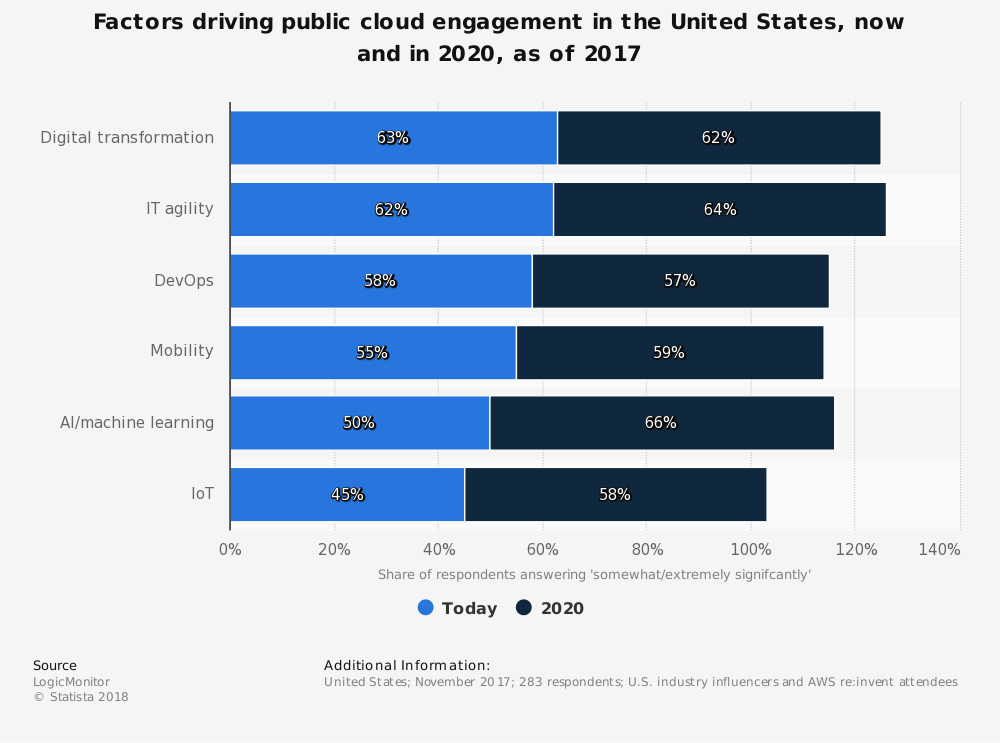

Machine learning and cloud technology go hand-in-hand. So much so, that by 2020 around 66 percent of organisations will embrace machine learning and artificial intelligence in their public cloud strategies.

66 percent of organisations plan to adopt machine learning and artificial intelligence in their public cloud strategies by 2020.

66 percent of organisations plan to adopt machine learning and artificial intelligence in their public cloud strategies by 2020.

Moving your Excel workloads to Azure will ensure your organisation has enough room to accommodate your predictive modelling efforts.

And it’s easier than you might think. One method that can provide your business with the benefits of Azure Machine Learning (AML), involves simply calling upon published web servicesstraight from an Excel add-in. Unlike Excel’s self-service add-ins, such as Power Pivot, these web services allow your business to get a taste of cloud-fuelled Excel modelling.

When using these web services, your business can continue to collect and model data in Excel, while moving your predictive and forecasting efforts to the cloud. In turn, providing you with the flexibility to expand your machine learning efforts and the visualisation to turn them into business insights.

But how exactly can Azure Machine Learning boost your financial predictive analytics?

Using Azure Machine Learning

The financial modelling community has always used the best technology to help them reach their goals. By making the most of the Azure cloud, these businesses can push past heritage barriers and advance their current efforts.

Almost anyone can use Azure’s data-driven services, such as Azure Machine Learning (ML), , regardless of their technical know-how or background experience. Whether you’re using the Excel plug-in or dipping into the service itself, the program’s intuitive drag and drop functionality makes it easy to understand and get to grips with. What’s more, with almost unlimited storage, your predictive modelling and data analytics is only limited by your own efforts.

Azure ML has an algorithm for almost any financial predictive analytics function. This includes:

- Predicting values, such as product demand, sales figures, and determining equipment or services priorities.

- Finding unusual occurrences, including credit risk, fraud detection, and abnormal equipment readings.

- Discovering structure. With Azure ML, your business can create customer segmentation, predict customer’s tastes and dislikes, and find out which products fail.

- Predicting between two categories or questions such as any yes/no or true/false question.

- Predicting between several categories and being able to answer complex questions.

You can use these algorithms to provide the insights you need to streamline company processes, differentiate your business from the competition and predict important company information.

Boosting Excel predictive models with Azure Calculation Engine

Another method that we’ve had success with involves our Azure Calculation Engine (ACE). This tool is capable of enhancing Excel forecasting and modelling in a number of unique ways:

- Deliver high performance calculations as a service

- Run multiple computations in parallel and in batch

- Scale cloud processers to run models at higher frequencies (if needed)

- Eliminate the cost of redundant infrastructure

In short, this can speed up your business’s financial predictive analytic efforts, ensure you have enough processing power to run your models throughout busier periods, and allow you to run multiple computations instead of working on them one-by-one.

By migrating your predictive workloads to the Azure cloud, your company benefits from a reduction in on-premise infrastructure resources costs, freeing up time and money for business innovation.

Excel's Financial Predictive Analytics in Action

ACE proved particularly useful in our engagement with leading commercial real estate company, Telereal Trillium, helping improve their financial forecasting capabilities.

With their budgetary forecasting application beginning to reach capacity on-premises, the firm was unable to manage long-term forecasts or scale their efforts as they continued to grow.

By migrating this forecasting model to the Azure cloud, the real estate company:

- Saw an 88 percent reduction in process execution times

- Was able to scale their forecasting and predictive modelling efforts

- Saved 2.2 million over a five-year period by moving key workloads to the Azure cloud

- Experienced zero upfront capital costs

With the right boost to your Excel modelling capabilities, your financial firm can see results like this too. But what else can predictive modelling help you achieve?

Where else can predictive modelling take the financial services?

The world of predictive analytics and machine learning can improve a range of financial services.

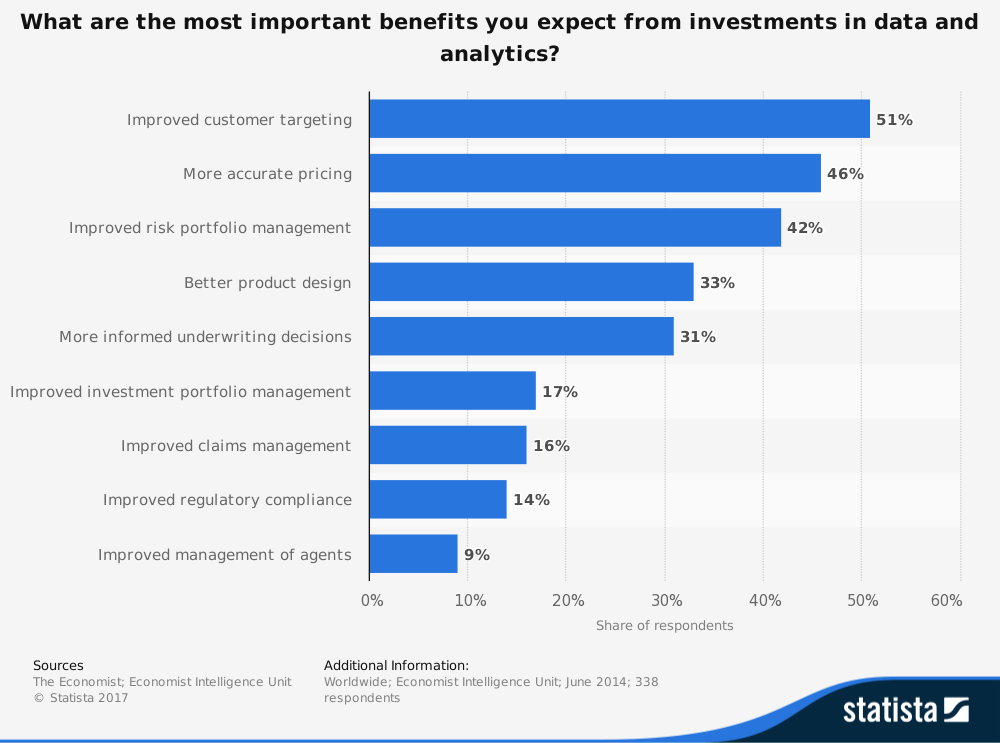

For example, 42 percent of insurance companies state one of the biggest benefits of data and analytics investments is improved risk portfolio management. Furthermore, 31 percent of businesses believe predictive analytics leads to better underwriting decisions.

42 percent of insurers cite ‘improved risk portfolio management’ as the most important benefit of data and analytic investments.

42 percent of insurers cite ‘improved risk portfolio management’ as the most important benefit of data and analytic investments.

With ACE and Excel’s Azure Machine Learning add-in and other Azure services, your financial firm can begin to improve upon your traditional Excel data sets to create high-frequency, accurate and scalable predictive models. Areas where machine learning can benefit the finance sector include:

- Identifying the best deals. Fundworks, a Californian finance provider, uses Azure’s capabilities to create predictive models which identify high-performing brokers, merchants, and deals. This ultimately helps the organisation to make more profitable and impactful business decisions.

- Predicting credit risk. In a helpful walk-through, Microsoft has demonstrated the capabilities of Azure in regards to determining credit risk. The model they created is able to detect credit card fraud indicators, medical problems or simple errors within text. By combing these criteria, the algorithm can calculate the credit risk of each individual. Azure’s scalability allows the model to run at high frequency to ensure no anomaly is overlooked.

- Determining insurance risk. Predictive models that feed through weather forecast information could help to determine home insurance risks. For example, a home situated in a regularly-flooded area could impact insurance rates. With this hindsight, insurers can make risk-aware home insurance decisions and automate unbiased underwriting processes which can, in turn, save time and money.

- Measuring market impact. By collecting data from the wider market, firms can create smart, predictive models that evaluate the effect of their trading efforts in comparison to market standards. By harnessing the power of Azure, these models are able to run at high-frequencies, ensuring financial firms never miss trends and price changes within the market. This, in turn, helps organisations to time trading deals accurately and minimise execution costs.

Share the load with Excel and Azure

With the limitations of strictly on-premise Excel modelling becoming more and more apparent, it’s clear financial businesses need to broaden their horizons and invest in cloud-assisted predictive modelling.

With the help of our Azure Calculation Engine, your business can benefit from:

- An increase in uptime

- No capital costs

- Better scalability

- Parallel and batch forecasting

To find out more, visit our ACE page or take a look at our approach to predictive modelling in Azure.

- Back to Blog

- Newer Article

- Older Article

- Deeko on: The right framework means less guesswork: Why the ...

- MelissaEstesEDU on: Propel your organization into the future with all ...

- Samanath North on: How does Extended Reality (XR) outperform traditio...

- Sarah_Lennox on: Streamline cybersecurity with a best practices fra...

- Jams_C_Servers on: Unlocking the power of edge computing with HPE Gre...

- Sarah_Lennox on: Don’t know how to tackle sustainable IT? Start wit...

- VishBizOps on: Transform your business with cloud migration made ...

- Secure Access IT on: Protect your workloads with a platform agnostic wo...

- LoraAladjem on: A force for good: generative AI is creating new op...

- DrewWestra on: Achieve your digital ambitions with HPE Services: ...